XRP Price Prediction: Analyzing the Path to $3.60 and Beyond

#XRP

- Technical Breakout: XRP trading above key moving average and psychological $3.00 level indicates bullish momentum

- Fundamental Support: BRICS central bank strategy and Ripple's European expansion provide strong foundation for growth

- Market Sentiment: Overwhelmingly positive news flow and institutional interest support continued upward movement

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

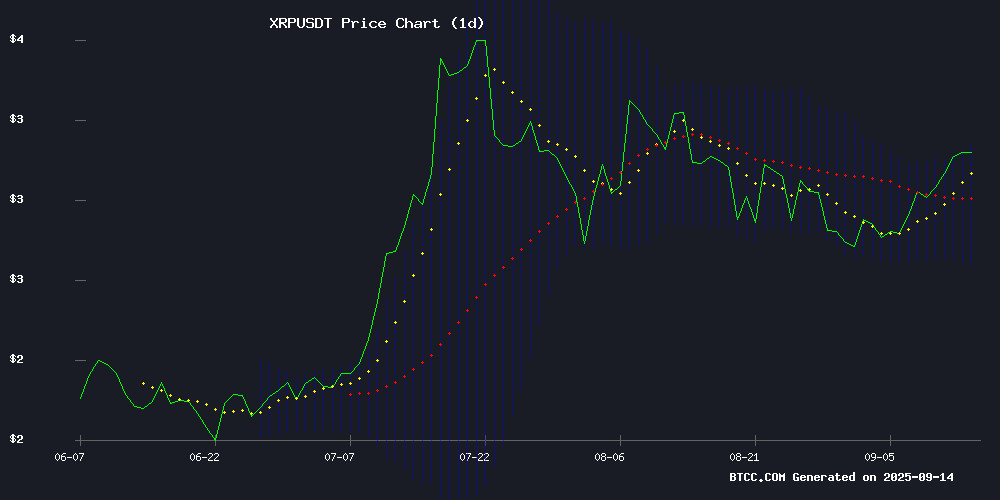

XRP is currently trading at $3.0443, positioned above its 20-day moving average of $2.9166, indicating underlying bullish momentum. The MACD reading of -0.0448 | 0.0407 | -0.0855 suggests some near-term consolidation, though the price remains within the Bollinger Band range of $2.6970 to $3.1362. According to BTCC financial analyst Olivia, 'The ability to hold above the $3.00 psychological level, combined with trading above the middle Bollinger Band, suggests continued strength. A break above the upper band at $3.1362 could signal further upside potential.'

Market Sentiment: Positive News Flow Supports XRP's Bullish Narrative

Recent news headlines reflect overwhelmingly positive sentiment toward XRP, with multiple reports highlighting key resistance breaks, institutional adoption, and development milestones. The BRICS central banks' multi-year XRP development strategy and Ripple's European expansion provide fundamental support. BTCC financial analyst Olivia notes, 'The combination of technical breakouts and substantial fundamental developments creates a favorable environment for XRP. However, declining volume amid price climbs warrants cautious Optimism as we monitor for sustained institutional inflows.'

Factors Influencing XRP's Price

OPTO Miner Cloud Mining Gains Traction as Investors Seek Stable Crypto Alternatives

As global cryptocurrency markets remain volatile, investors are shifting from speculative trading to more structured investment approaches. XRP's growing adoption in cross-border payments has boosted trading volume, yet its price continues to mirror broader market swings. This uncertainty is driving interest in predictable alternatives to coin holding and high-frequency trading.

Cloud mining emerges as a compelling solution, overcoming traditional barriers like hardware costs and operational complexity. By virtualizing computing power through contractual mechanisms, platforms like OPTO Miner allow investors to participate in blockchain networks without physical infrastructure. Transparent profit structures and defined cycles offer output predictability—a potential hedge against single-coin price volatility.

XRP Breaks Key Resistance, Eyes $4 as Savvy Mining Offers Yield Opportunities

XRP surged past its 2018 all-time high of $3.40 on July 18, peaking at $3.65 before consolidating at $3.20. The 7% rebound demonstrates strong technical support at $3, with RSI maintaining bullish territory above 50. Market structure suggests an imminent test of the $4 psychological barrier.

While price appreciation dominates discussions, Savvy Mining presents an alternative for yield-seeking holders. The platform enables cloud-based XRP mining contracts without hardware requirements, generating daily returns uncorrelated to spot price movements. Daily settlements and flexible withdrawal options provide cash FLOW alongside potential capital gains.

The service taps into growing demand for institutional-grade yield products beyond ETF exposure. Unlike Bitcoin and Ethereum's established ETF markets, XRP derivatives remain underdeveloped, creating opportunities for compliant cloud mining solutions. Savvy Mining combines AI-driven compute management with renewable energy infrastructure, positioning itself as a regulated alternative to physical mining operations.

Can Ripple’s XRP Surge Beyond $5 in 2025? AI Models Weigh In

Ripple’s XRP has defied expectations in 2025, soaring from under $0.60 to a record $3.65 in July before consolidating NEAR the $3 support level. The cryptocurrency now faces a critical juncture: whether it can sustain momentum for a push toward $5. Three leading AI models—ChatGPT, Gemini, and Grok—offer divergent perspectives on its potential.

Technical analysis suggests a breakout above $3.40-$3.50 could fuel further gains, while market sentiment remains divided. XRP’s resurgence as the third-largest crypto by market cap underscores its resilience, yet volatility persists. The asset’s performance hinges on broader adoption and regulatory clarity, with traders watching key resistance levels for confirmation of a bullish continuation.

Early XRP Investors Reap Million-Dollar Returns as Ripple's Legal Clarity Fuels Rally

Ripple's XRP has delivered staggering returns for early adopters, with a $1,000 investment in 2014 now valued at over $1 million. The token's 99,000% appreciation follows its resolution of SEC litigation and subsequent market resurgence, currently trading near $3.

Historical data reveals XRP traded at $0.002686 in 2014, meaning 372,816 tokens purchased then WOULD cross the seven-figure threshold today. While such exponential gains may not repeat, analysts project continued growth—with Changelly forecasting a $2,861 target by 2050, contrasted by Telegaon's more conservative $285.56 estimate.

The divergence in long-term predictions underscores XRP's volatile trajectory. Current buyers would require a $3,000 per token valuation to replicate million-dollar returns—a scenario deemed improbable before mid-century by most projections.

XRP Price Prediction: Ripple Targets $5 In 2025 Amid European Expansion, But Altcoin Remittix Emerges as Rival

XRP has surged past $3.04, reigniting bullish sentiment with a projected $5 target by 2025. The rebound follows Ripple's strategic European custody partnership with BBVA, reinforcing institutional confidence. Technical indicators show a breakout above the $2.94–$2.99 EMA cluster, with $3.10 as the next resistance threshold. A sustained rally could propel prices toward $3.50, though failure to hold $3.00 risks a retracement to $2.75.

Meanwhile, PayFi's Remittix token enters the spotlight after raising $25.4 million at $0.1080 per token. Analysts suggest its remittance-focused model may achieve faster real-world adoption than Ripple's infrastructure play. The altcoin's lower entry point and niche positioning attract traders seeking asymmetric growth opportunities.

XRP Ledger's XLS-86 Firewall Update to Enhance Investor Protection Against Scams

Developers are preparing to roll out a critical security upgrade for the XRP Ledger (XRPL) with the XLS-86 Firewall amendment. This update, announced by dUNL Validator 'Vet,' aims to curb wallet drain scams by allowing customizable transaction restrictions and whitelisting trusted accounts.

The firewall introduces time-based and value-based limits on outgoing transactions, creating a buffer against unauthorized withdrawals even if private keys are compromised. Account owners gain reactive time to secure assets—a direct response to past community losses.

Market observers note this could bolster confidence in XRP holdings, particularly among retail investors historically vulnerable to exploit attempts. The whitelist feature further refines security by permitting pre-approved transactional pathways.

iPhone Prices Measured in XRP Show Cryptocurrency's Volatility Over Time

The cost of iPhones denominated in XRP tokens reveals dramatic shifts in cryptocurrency valuation. Early models like the iPhone 7 required 94,703 XRP at peak—a staggering sum reflecting the token's low valuation during its 2016 release.

Subsequent models show XRP's appreciation. The iPhone 8 dropped to 3,976 XRP, while the iPhone X settled at 4,943 tokens. By iPhone 11, the price had declined further to 2,436 XRP, demonstrating the cryptocurrency's growing purchasing power.

This historical comparison underscores XRP's journey from speculative asset to more stable valuation. The data, compiled by XPmarket, provides crypto enthusiasts with tangible evidence of blockchain's evolving role in global commerce.

BRICS Central Banks Confirm Multi-Year XRP Development Strategy

BRICS central banks have quietly built a multi-year strategy around XRP Ledger technology, according to newly uncovered documents. The bloc's financial institutions appear to have Leveraged XRPL's escrow and automation features as foundational elements in their de-dollarization efforts.

Archived materials from BRICS forums reveal persistent integration work dating back years, with the New Development Bank spearheading technical implementations. Policy documents consistently reference XRPL infrastructure for trade finance and cross-border settlement use cases.

The revelations come as BRICS nations accelerate alternatives to dollar-based clearing systems. Brazil's central bank has reportedly confirmed participation in these initiatives, though operational details remain guarded.

XRP Holds $3.00 as Bulls Eye Breakout Toward $3.60

XRP surged past the $3.00 psychological barrier, fueled by institutional interest and a spike in trading volumes. The token oscillated between $2.96 and $2.99 before a midday push to $3.02, backed by volume six times the daily average. Resistance at $3.02 proved stubborn, but bulls held firm at $2.98, reinforcing support.

Heavy flows dominated the September 10 rally, with hourly trades exceeding 119 million XRP—more than double the 24-hour average. Futures open interest climbed to $7.94 billion, reflecting aggressive derivatives activity alongside spot demand. Analysts project a breakout toward $3.20, with $3.60 in sight if momentum persists.

Technical indicators underscore bullish conviction. Higher lows confirm accumulation, while buyers consistently absorbed sell pressure near $2.98. A sustained close above $3.00 could pivot the level into support, triggering a rally toward Fibonacci targets. With open interest at historic highs, volatility appears imminent.

Bearish Divergence Threatens XRP Price Rally Despite Institutional Inflows

XRP's recent price rally faces a potential setback as technical indicators reveal a bearish divergence, contrasting with strong institutional interest. Open interest in XRP futures contracts on the Chicago Mercantile Exchange (CME) reached a 10-day high of 384,500 XRP, signaling growing participation from larger market players.

Institutional flows, often associated with deeper liquidity and reduced volatility, suggest this rally is driven by long-term capital rather than speculative trading. On-chain metrics support this thesis, with XRP's Liveliness indicator—tracking dormant token movement—hitting a 52-day low, reflecting long-term holder conviction.

The divergence between fundamental strength and technical weakness creates a tension point for traders. While institutions appear to be building positions, chart patterns warn of potential near-term downside. Market participants now weigh whether the institutional bid will overpower the emerging technical headwinds.

XRP Price Climbs Amid Declining Volume as Market Cap Nears $179 Billion

Ripple's XRP edged higher to $3.00 Thursday, marking a 0.99% gain despite a 12.61% drop in trading volume. The token's $4.3 billion daily turnover suggests weakening momentum, though its 6.33% weekly gain maintains bullish sentiment.

Market capitalization now stands at $178.65 billion as altcoins show mixed performance. Mantle, Pump.fun and Avalanche lead 24-hour gainers, while Worldcoin, Ethena and Pyth Network face the steepest declines.

The volume-price divergence presents a classic consolidation pattern—either prelude to breakout or warning of exhaustion. Traders await either fresh catalysts or profit-taking signals as XRP tests key psychological resistance.

Will XRP Price Hit 3?

XRP has already surpassed the $3.00 level, currently trading at $3.0443. The technical setup suggests potential for further gains toward $3.60, supported by positive market sentiment and fundamental developments. Key factors to monitor include:

| Indicator | Current Value | Significance |

|---|---|---|

| Current Price | $3.0443 | Already above $3.00 target |

| 20-day MA | $2.9166 | Price trading above support |

| Bollinger Upper | $3.1362 | Next resistance level |

| Market Sentiment | Bullish | Supported by news flow |

With strong institutional interest and technical momentum, maintaining above $3.00 appears sustainable in the near term.